When you're in the business of complexification

As I was doing my taxes this year with TurboTax, I couldn’t help but be impressed by the way TurboTax incorporates online help directly into its UI. For an extremely confusing topic, TurboTax seems to add just the right amount of help in a convenient, easily accessible way. It’s easy to celebrate their online app as a great way to do help.

But after I championed TurboTax a bit with my wife, she brought up the counter-argument, explaining that they want you to think that you can’t possibly do taxes on your own. You become entirely dependent on them to help you through the confusing tax landscape.

It’s an interesting idea. As technical writers, we often stake our value in simplifying complexity. But some companies actually thrive on complexity and build their business around it (this is what I mean by “complexification” — intentional complexity). It’s in TurboTax’s best interest to persuade you that doing your taxes is an incredibly complicated process that requires deep knowledge of arcane tax forms and credits and other strategies in order to get the return you deserve. The only real solution is … to buy their software so you can survive the April 15 ordeal.

That may be true (the tax code is complex on its own, independent of TurboTax), but I can’t help but feel that there’s a category of businesses that thrive on complexification. The more complex the tax code, the more appealing TurboTax becomes. If taxes were simplified, there would be little incentive to buy TurboTax.

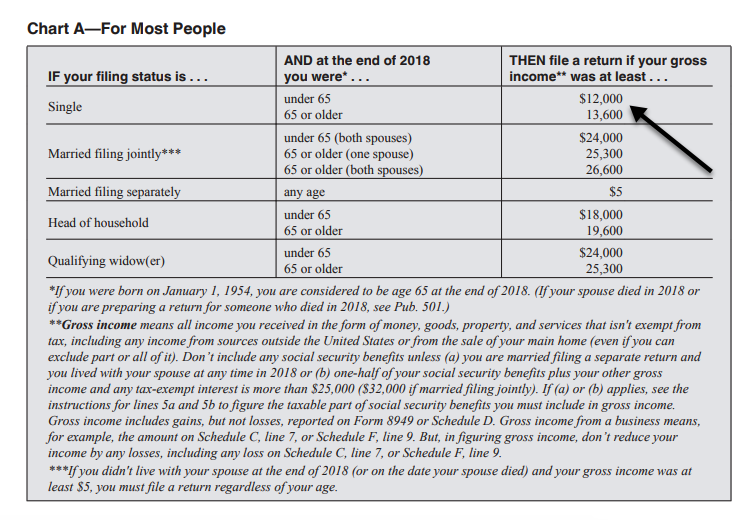

The IRS thrives on complexification as well. The more complex your taxes, the more they stand to benefit from you not doing your taxes properly. The more confusing they can make it to get your refund, the more money they can keep. Here’s a simple example. Suppose you’re a 17-year-old kid who just earned a few thousand dollars from a summer of lifeguarding (as was the case with my oldest daughter). You’re not sure if you need to pay taxes, so you look up the instructions for 1040 to see the minimum filing requirements:

From this it would appear that you don’t need to file taxes unless you make at least $12,000. What a relief! What they fail to tell you is that if you don’t file taxes, you’re letting the government keep your refund. A more appropriate description here might say, “You’re not required to file. But if you do not file, the government gets to keep your refund, if you have one available. If you choose this option, we thank you for your donation.”

The first year my daughter needed to do taxes, we looked up the minimum filing requirements, saw the threshold, and skipped filing. This year, realizing that we were leaving money with the government, we filed both 2018 and 2017 taxes to collect nearly $500 in refunds from her summers of lifeguarding.

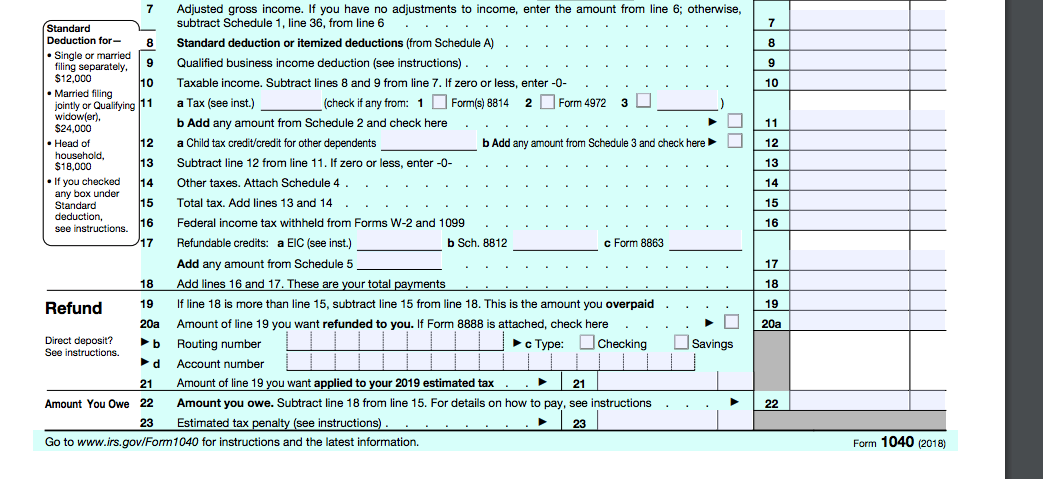

Also, if you’ve ever tried filling out the paper method of the 1040 form (required for doing back taxes), there’s a fun puzzle-like logic you have to complete. Add these numbers, subtract from this line, add in this number and subtract it from the sum of the other two, and so on. I have to wonder if the IRS purposely tries to make what should probably be automated directly from the W-2 into a chicanery of instructions just to complexify the situation.

Maybe the IRS is full of earnest people who have attempted to simplify the tax code as much as possible. Or not. I’m not sure. This morning I read that TurboTax lobbied the IRS to eliminate the government from creating free or simpler solutions for filing taxes — see TurboTax, H&R Block Spend Big Bucks Lobbying for Us to Keep Doing Our Own Taxes.

Huh? I don’t quite understand why the IRS would bow to this lobby, but it confirms my suspicions that complexity is working in the business interests of both groups, and they have no real desire to simplify the process — only to simplify your decision to buy their software, or to let the government keep your refund.

As technical writers, this phenomenon is interesting because we’re in the business of simplification. It’s good to remember that others are in the business of complexification. But in a way, we too benefit from complexification. The more confusing a process is, the more people become dependent on technical writers. So I don’t necessarily think tech writers are completely opposite categories.

But it is good to remember that in some scenarios, companies stand to benefit from complex processes, and replacing them with simple ones might shake their whole business model. In the example of TurboTax, they ingeniously provide seamlessly integrated help to appear as if they are simplifying taxes for you, while working feverishly behind the scenes with the IRS to make sure the tax process — outside of their software usage — remains a complex, murky mess that no one dare undertake on their own.

About Tom Johnson

I'm an API technical writer based in the Seattle area. On this blog, I write about topics related to technical writing and communication — such as software documentation, API documentation, AI, information architecture, content strategy, writing processes, plain language, tech comm careers, and more. Check out my API documentation course if you're looking for more info about documenting APIs. Or see my posts on AI and AI course section for more on the latest in AI and tech comm.

If you're a technical writer and want to keep on top of the latest trends in the tech comm, be sure to subscribe to email updates below. You can also learn more about me or contact me. Finally, note that the opinions I express on my blog are my own points of view, not that of my employer.